Widget System Risk Analysis Report

Example quantrr risk analysis of the “Widget Management System” (WMS).

Environment Statement

The Widget Management System (WMS) is over 30 years old and its architecture has not changed significantly since the original implementation. Over the years, the widget system has become an integral part of our services in managing widgets for our clients. In reviewing the system, three major risks were identified: First, the age of the technology prevents updating components of the system that no longer meet contemporary cybersecurity standards, which increases the likelihood of a breach. Second, the system is less reliable and experiences frequent outages, typically about 2 major outages per year, which results in lost revenue, contractual penalties, and overtime pay to recover from the incident. Third, limitations of the widget system have started to affect sales - we have recently lost a customer due to the functional obsolescence of the widget system, and expect to both lose more existing and prospective customers in the future due to increased competition in the widget management market.

Experts were asked to consider two risk treatment scenarios:

- None: The current system as it is today (baseline risk)

- Replace: Complete replacement of the WMS with a modern, customer-centric solution

Import

Import and validate data from Excel.

The data was collected from 3 Technology SMEs, 3 Business SMEs, and one SME with experience in both. Experts were calibrated, informed by historical and industry data, and only gave estimates for areas in which they were confident in answering.

Code

risks <- read_xlsx(report_file, sheet = "Risks") |>

clean_names()

validate_risks <- local({

validate_rules <- validator(

risk_char = is.character(risk),

risk_not_na = !is.na(risk),

risk_not_blank = nzchar(risk, keep_na = TRUE),

desc_char = is.character(description),

desc_not_na = !is.na(description),

desc_not_blank = nzchar(risk, keep_na = TRUE)

)

confront(risks, validate_rules)

})

check_validation(validate_risks, sheet = "Risks")

treatments <- read_xlsx(report_file, sheet = "Treatments") |>

clean_names()

validate_treatments <- local({

validate_rules <- validator(

treatment_char = is.character(treatment),

treatment_not_na = !is.na(treatment),

treatment_not_blank = nzchar(treatment, keep_na = TRUE),

desc_char = is.character(description),

desc_not_na = !is.na(description),

desc_not_blank = nzchar(treatment, keep_na = TRUE)

)

confront(treatments, validate_rules)

})

check_validation(validate_treatments, sheet = "Treatments")

estimates <- read_xlsx(report_file, sheet = "Estimates") |>

clean_names() |>

rename(

lambda = frequency_per_yer, p50 = most_likely, p95 = high_95_percent, p05 = low_5_percent

)

validate_estimates <- local({

validate_rules <- validator(

risk_not_na = !is.na(risk),

risk_match = risk %in% risks$risk,

expert_char = is.character(expert),

expert_not_na = !is.na(expert),

expert_not_blank = nzchar(expert, keep_na = TRUE),

lambda_num = is.numeric(lambda),

lambda_pos = lambda > 0,

p50_num = is.numeric(p50),

p50_pos = p50 > 0,

p95_num = is.numeric(p95),

p95_pos = p95 > 0,

p05_num = is.numeric(p05),

p05_pos = p05 > 0

)

confront(estimates, validate_rules)

})

check_validation(validate_estimates, sheet = "Estimates")Risks

Risk descriptions:

Code

formattable(risks, align = "l")| risk | description |

|---|---|

| Cybersecurity Breach | Risk of a cybersecurity breach of the inventory system. |

| Technology Outage | Risk of an inventory system outage. |

| Loss of Customer | Risk of losing and existing customer or failure to acquire a new customer due to functional limitations of the inventory system. |

Treatment descriptions:

Code

formattable(treatments, align = "l")| treatment | description |

|---|---|

| None | Current system as it is today |

| Replace | Replace WMS with a modern solution |

Forecast

Forecast risk using Monte Carlo simulation. The average events, losses, ‘typical’ losses (geometric mean), and percentage of years with no losses for each risk and treatment are summarized below:

Code

consensus <- estimates |>

group_by(treatment, risk) |>

summarize(across(lambda:p05, ~ mean(.x, na.rm = TRUE)), .groups = "drop")

consensus_params <- consensus |>

mutate(as_tibble(lnorm_param(p50 = .data$p50, p95 = .data$p95, p05 = .data$p05)))

forecast <- consensus_params |>

select(c("risk", "lambda", "meanlog", "sdlog", "treatment")) |>

pmap(calc_risk) |>

list_rbind()

forecast |>

group_by(treatment, risk) |>

mutate(no_losses = events == 0) |>

summarize(

avg_events = mean(events), avg_losses = mean(losses), typ_losses = gmean(losses),

no_losses = mean(no_losses), .groups = "drop"

) |>

mutate(

across(avg_losses:typ_losses, ~ currency(.x, digits = 0L)),

no_losses = percent(no_losses)

) |>

formattable(align = "l")| treatment | risk | avg_events | avg_losses | typ_losses | no_losses |

|---|---|---|---|---|---|

| None | Cybersecurity Breach | 0.25760 | $5,830,131 | $361,506 | 77.36% |

| None | Loss of Customer | 2.00492 | $10,717,189 | $4,291,229 | 13.14% |

| None | Technology Outage | 2.01368 | $96,858 | $35,381 | 13.65% |

| Replace | Cybersecurity Breach | 0.10044 | $2,144,844 | $318,752 | 90.41% |

| Replace | Loss of Customer | 0.23544 | $1,140,109 | $1,617,617 | 79.17% |

| Replace | Technology Outage | 1.11980 | $42,246 | $18,860 | 32.59% |

Losses

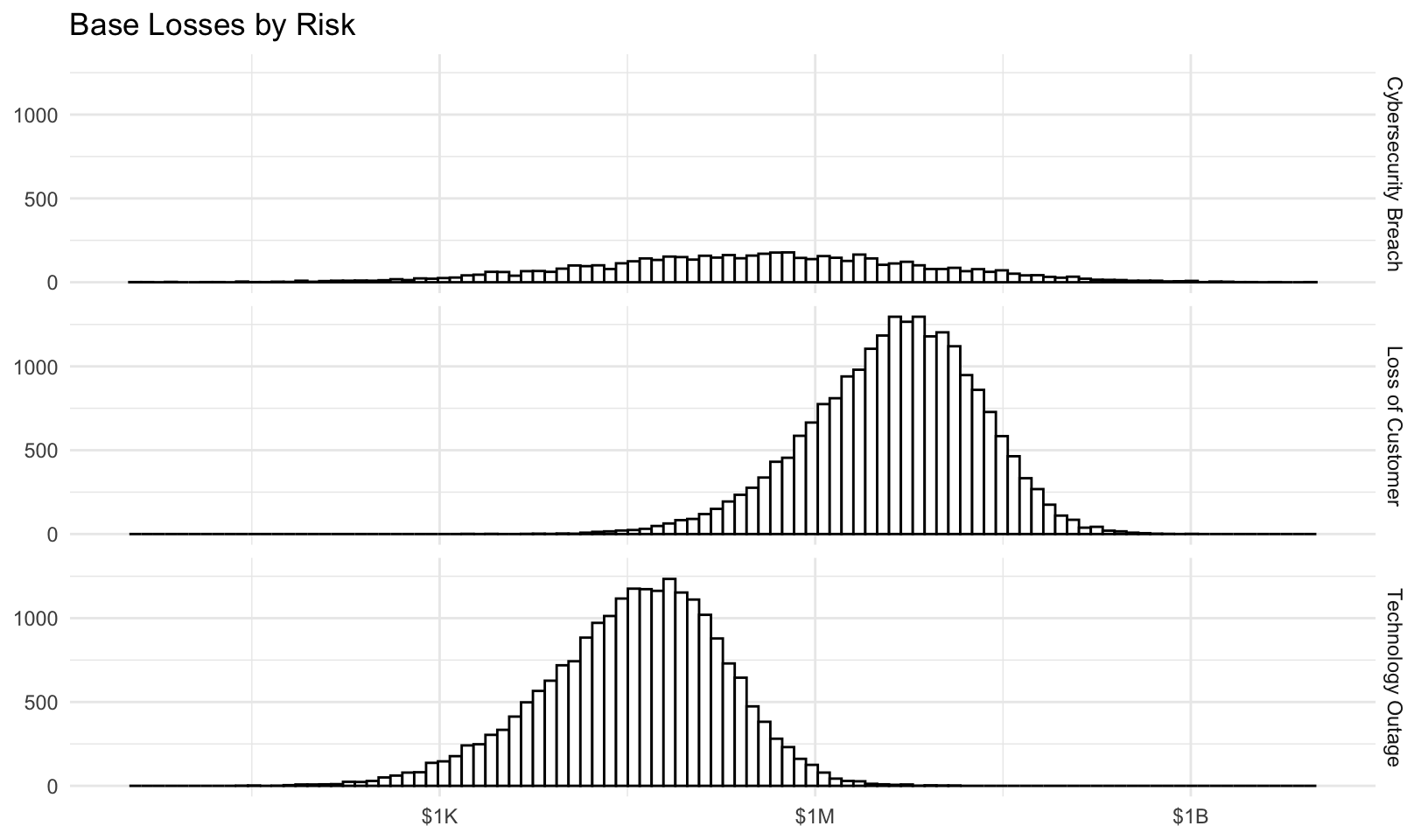

Base losses (with no risk treatment) by risk:

Code

forecast |>

filter(tolower(treatment) == "none") |>

# remove zero losses to plot using log10 scale

filter(losses > 0) |>

ggplot(aes(losses)) +

facet_grid(vars(risk)) +

geom_histogram(color = "black", fill = "white", bins = 100) +

scale_x_log10(labels = scales::label_currency(scale_cut = scales::cut_short_scale())) +

labs(x = NULL, y = NULL, title = "Base Losses by Risk") +

theme_minimal()

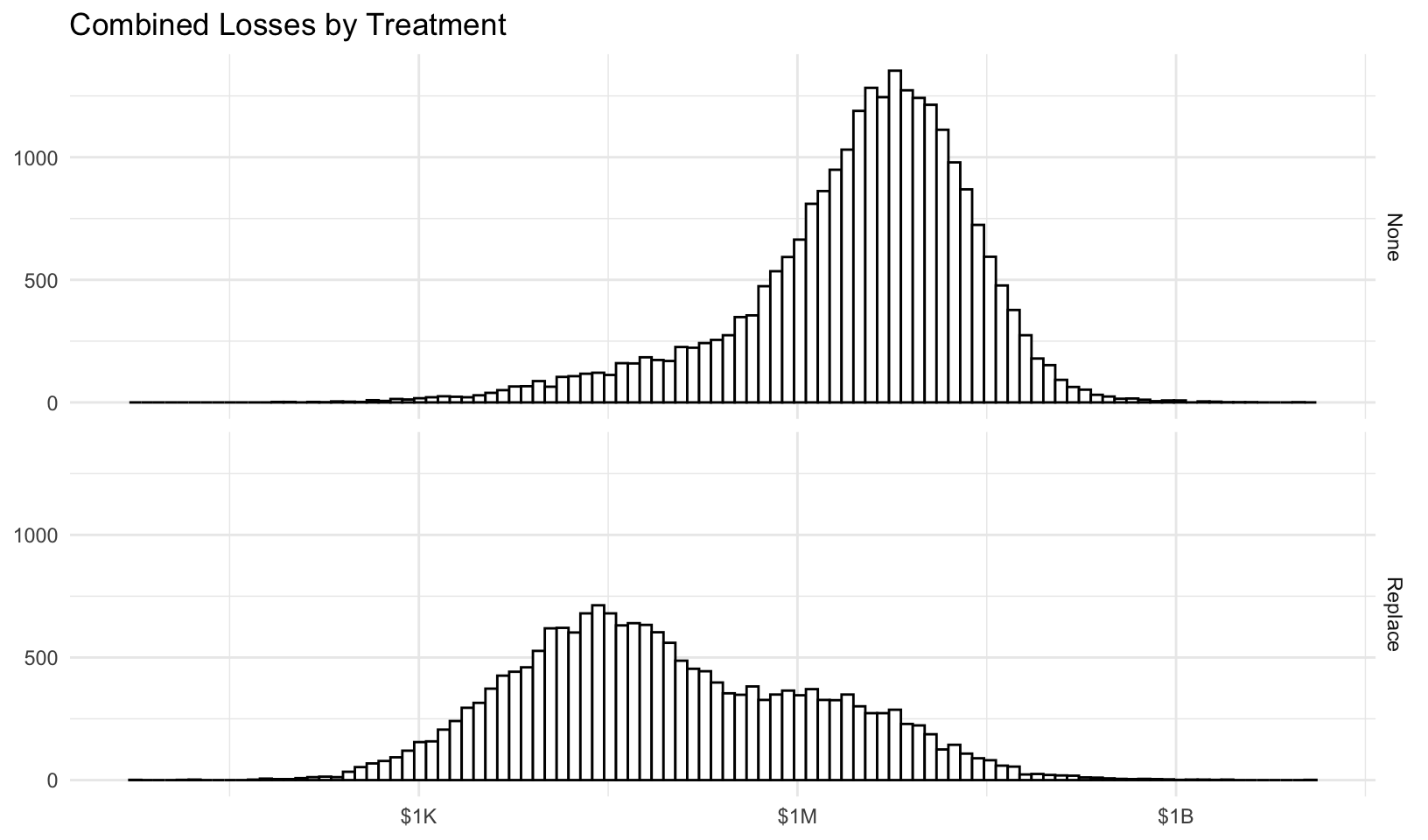

Combined losses by treatment:

Code

forecast |>

group_by(treatment, year) |>

summarize(total_losses = sum(losses), .groups = "drop_last") |>

# remove zero losses to plot using log10 scale

filter(total_losses > 0) |>

ggplot(aes(total_losses)) +

facet_grid(vars(treatment)) +

geom_histogram(color = "black", fill = "white", bins = 100) +

scale_x_log10(labels = scales::label_currency(scale_cut = scales::cut_short_scale())) +

labs(x = NULL, y = NULL, title = "Combined Losses by Treatment") +

theme_minimal()

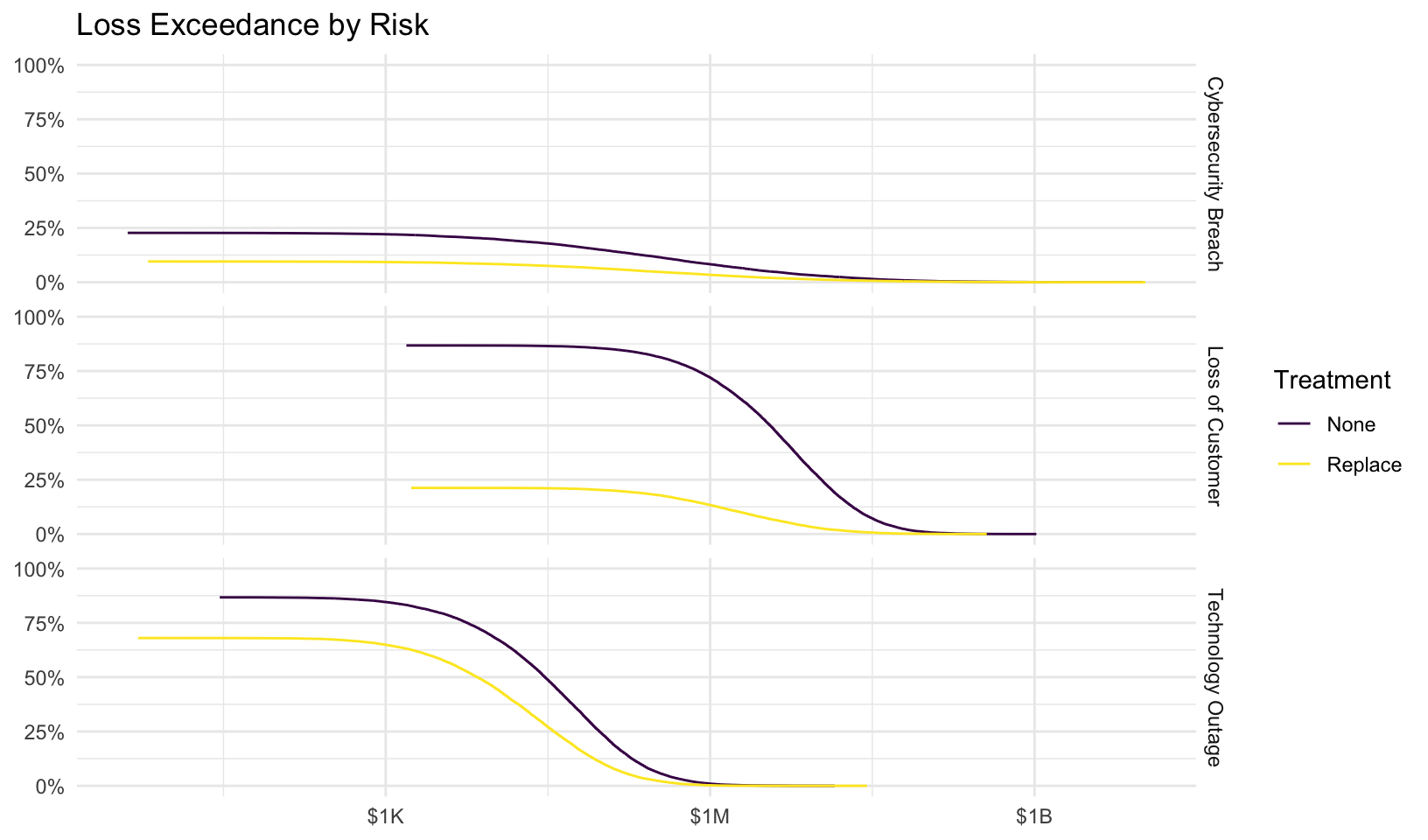

Loss Exceedance Curves

Plot loss exceedance curves for all risks and combined risk, with risk treatments.

By Risk

Plot loss exceedance curves for each risk:

Code

risk_le <- forecast |>

group_by(risk, treatment) |>

mutate(probability = 1 - percent_rank(losses)) |>

filter(losses > 0) |>

ungroup() |>

mutate(losses = currency(losses, digits = 0), probability = percent(probability)) |>

ggplot(aes(losses, probability, color = treatment)) +

facet_grid(vars(risk)) +

geom_line() +

scale_y_continuous(labels = scales::label_percent(), limits = c(0, 1)) +

scale_x_log10(labels = scales::label_currency(scale_cut = scales::cut_short_scale())) +

labs(x = NULL, y = NULL, color = "Treatment", title = "Loss Exceedance by Risk") +

scale_color_viridis_d() +

theme_minimal()

risk_le

Interactive plot:

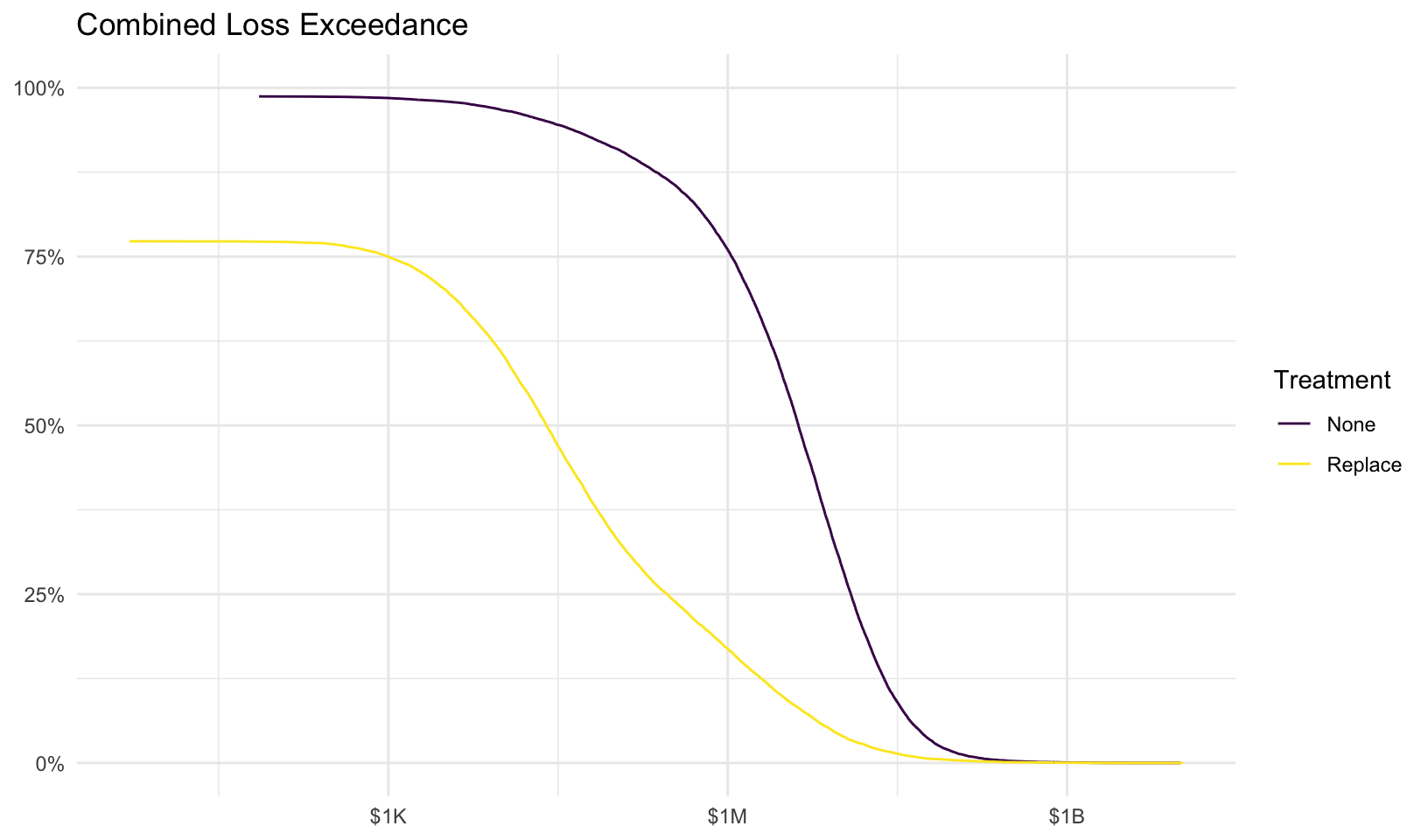

Combined Risk

Plot loss exceedance curve for combined risk:

Code

combined_le <- forecast |>

group_by(treatment, year) |>

summarize(total_losses = sum(losses), .groups = "drop_last") |>

mutate(probability = 1 - percent_rank(total_losses)) |>

filter(total_losses > 0) |>

ungroup() |>

mutate(total_losses = currency(total_losses, digits = 0), probability = percent(probability)) |>

ggplot(aes(total_losses, probability, color = treatment)) +

geom_line() +

scale_y_continuous(labels = scales::label_percent(), limits = c(0, 1)) +

scale_x_log10(labels = scales::label_currency(scale_cut = scales::cut_short_scale())) +

labs(x = NULL, y = NULL, color = "Treatment", title = "Combined Loss Exceedance") +

scale_color_viridis_d() +

theme_minimal()

combined_le

Interactive plot:

Appendix

Additional details on the risk quantification analysis.

Validation

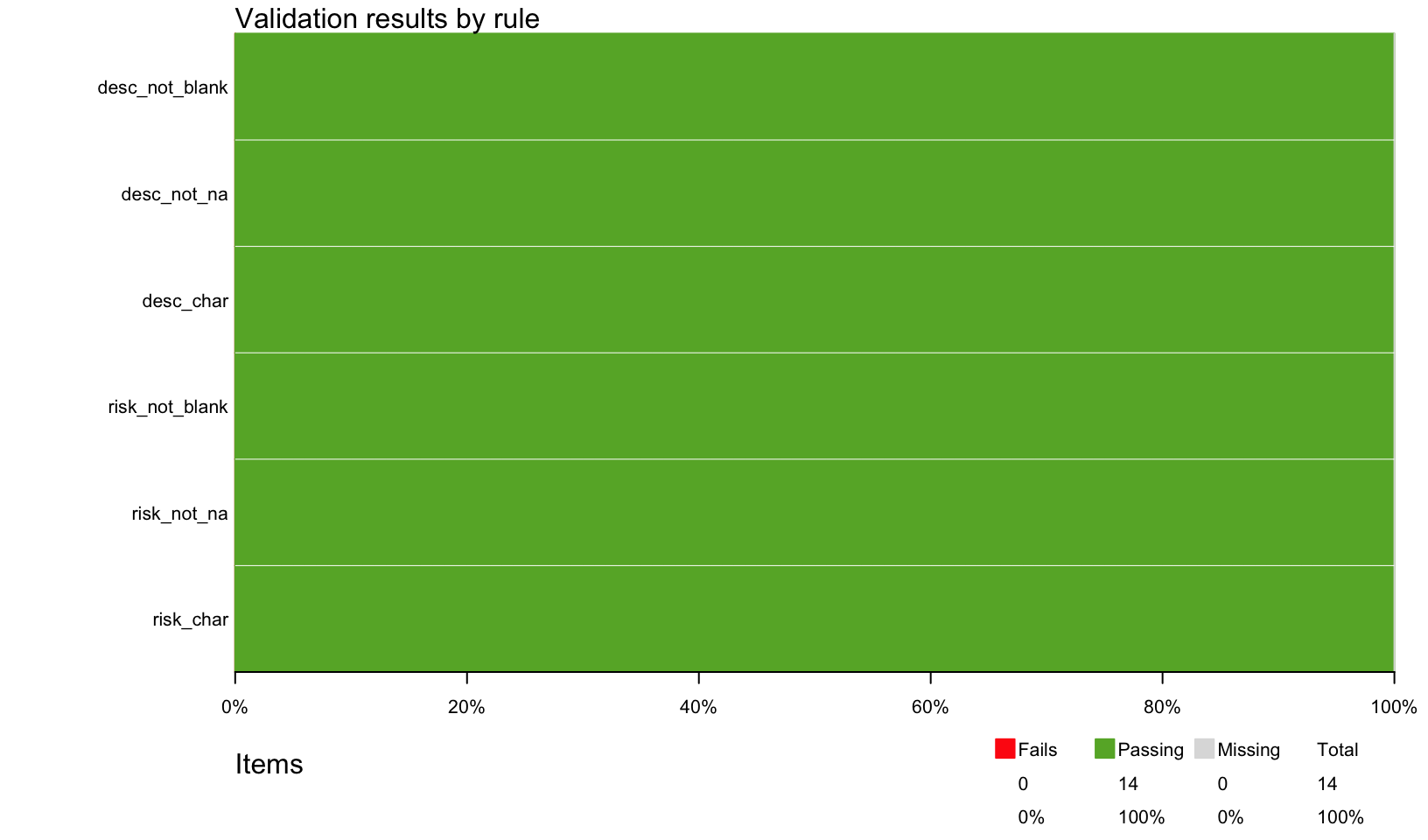

Data validation results for Risks tab:

Code

plot(validate_risks)

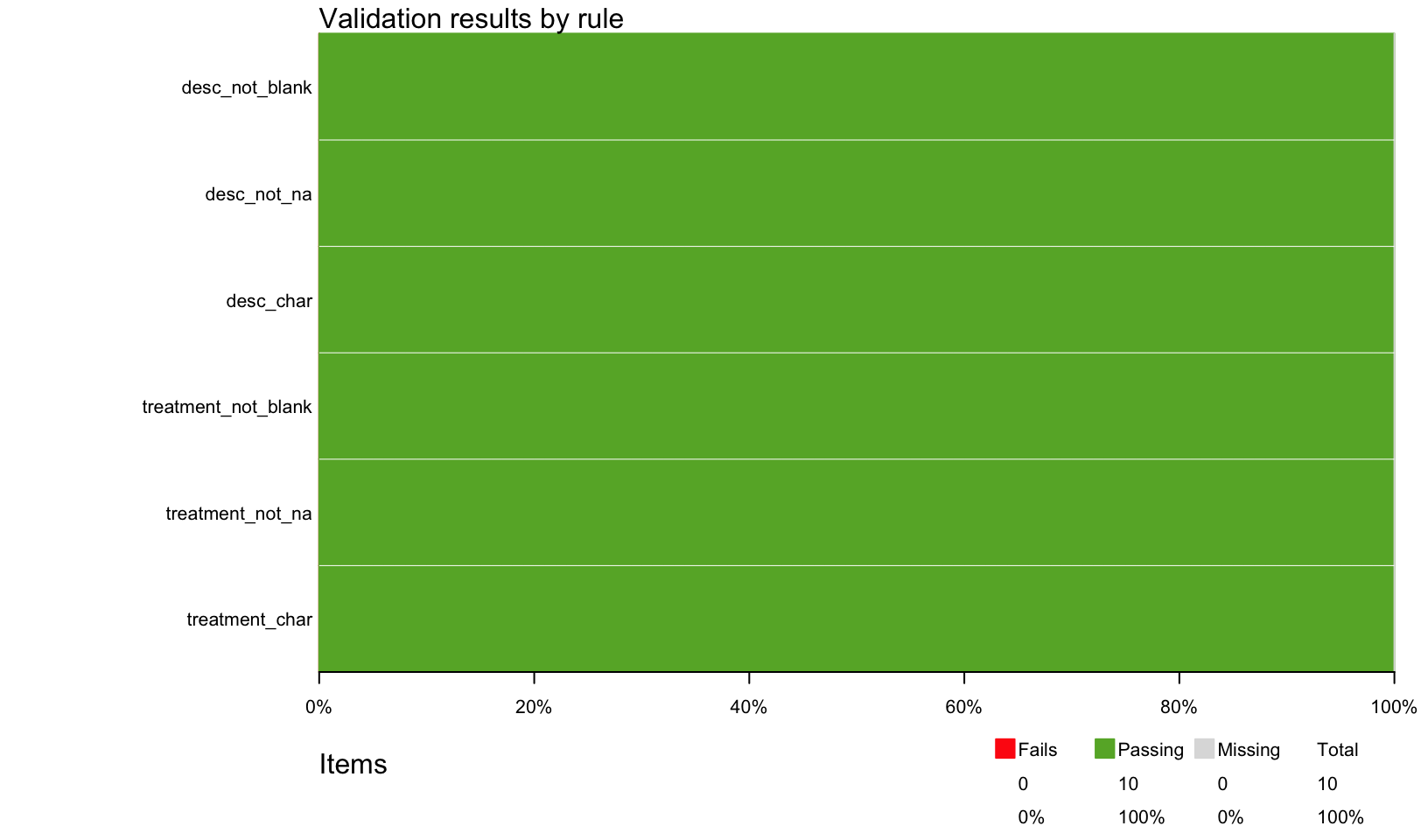

Data validation results for Treatments tab:

Code

plot(validate_treatments)

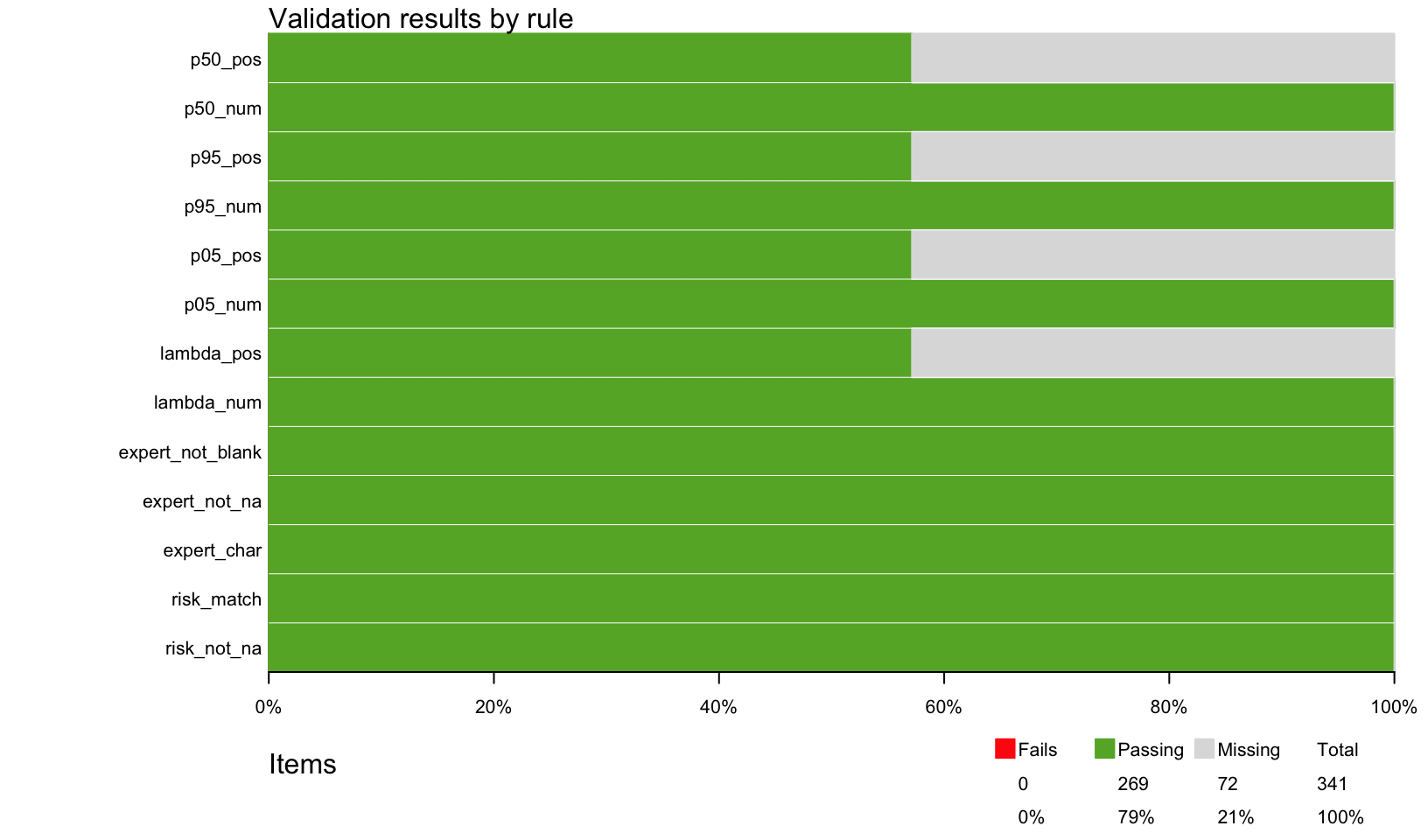

Data validation results for Estimates tab:

Code

plot(validate_estimates)

Estimates

All risk estimates:

Code

estimates |>

mutate(across(p50:p05, ~ currency(.x, digits = 0L))) |>

formattable(align = "l")| treatment | risk | expert | lambda | p50 | p95 | p05 |

|---|---|---|---|---|---|---|

| None | Cybersecurity Breach | Technology Expert 1 | 0.25 | NA | NA | NA |

| None | Cybersecurity Breach | Technology Expert 2 | 0.33 | NA | NA | NA |

| None | Cybersecurity Breach | Technology Expert 3 | 0.20 | NA | NA | NA |

| None | Cybersecurity Breach | Business Expert 1 | NA | $300,000 | $45,000,000 | $2,000 |

| None | Cybersecurity Breach | Business Expert 2 | NA | $200,000 | $34,000,000 | $1,400 |

| None | Cybersecurity Breach | Business Expert 3 | NA | $500,000 | $54,000,000 | $2,100 |

| None | Cybersecurity Breach | Unicorn Expert | 0.25 | $275,000 | $44,000,000 | $1,900 |

| None | Technology Outage | Technology Expert 1 | 2.00 | NA | NA | NA |

| None | Technology Outage | Technology Expert 2 | 3.00 | NA | NA | NA |

| None | Technology Outage | Technology Expert 3 | 1.00 | NA | NA | NA |

| None | Technology Outage | Business Expert 1 | NA | $15,000 | $200,000 | $700 |

| None | Technology Outage | Business Expert 2 | NA | $10,000 | $150,000 | $500 |

| None | Technology Outage | Business Expert 3 | NA | $11,000 | $180,000 | $675 |

| None | Technology Outage | Unicorn Expert | 2.00 | $16,000 | $220,000 | $800 |

| None | Loss of Customer | Technology Expert 1 | NA | NA | NA | NA |

| None | Loss of Customer | Technology Expert 2 | NA | NA | NA | NA |

| None | Loss of Customer | Technology Expert 3 | NA | NA | NA | NA |

| None | Loss of Customer | Business Expert 1 | 2.00 | $1,500,000 | $20,000,000 | $100,000 |

| None | Loss of Customer | Business Expert 2 | 3.00 | $2,000,000 | $30,000,000 | $150,000 |

| None | Loss of Customer | Business Expert 3 | 1.00 | $1,200,000 | $15,000,000 | $75,000 |

| None | Loss of Customer | Unicorn Expert | 2.00 | $1,000,000 | $15,000,000 | $75,000 |

| Replace | Cybersecurity Breach | Technology Expert 1 | 0.10 | NA | NA | NA |

| Replace | Cybersecurity Breach | Technology Expert 2 | 0.15 | NA | NA | NA |

| Replace | Cybersecurity Breach | Technology Expert 3 | 0.05 | NA | NA | NA |

| Replace | Cybersecurity Breach | Business Expert 1 | NA | $300,000 | $45,000,000 | $2,000 |

| Replace | Cybersecurity Breach | Business Expert 2 | NA | $200,000 | $34,000,000 | $1,400 |

| Replace | Cybersecurity Breach | Business Expert 3 | NA | $500,000 | $54,000,000 | $2,100 |

| Replace | Cybersecurity Breach | Unicorn Expert | 0.10 | $275,000 | $44,000,000 | $1,900 |

| Replace | Technology Outage | Technology Expert 1 | 1.00 | NA | NA | NA |

| Replace | Technology Outage | Technology Expert 2 | 1.50 | NA | NA | NA |

| Replace | Technology Outage | Technology Expert 3 | 1.00 | NA | NA | NA |

| Replace | Technology Outage | Business Expert 1 | NA | $10,000 | $150,000 | $700 |

| Replace | Technology Outage | Business Expert 2 | NA | $7,500 | $125,000 | $500 |

| Replace | Technology Outage | Business Expert 3 | NA | $10,000 | $160,000 | $675 |

| Replace | Technology Outage | Unicorn Expert | 1.00 | $11,000 | $155,000 | $800 |

| Replace | Loss of Customer | Technology Expert 1 | NA | NA | NA | NA |

| Replace | Loss of Customer | Technology Expert 2 | NA | NA | NA | NA |

| Replace | Loss of Customer | Technology Expert 3 | NA | NA | NA | NA |

| Replace | Loss of Customer | Business Expert 1 | 0.20 | $1,500,000 | $20,000,000 | $100,000 |

| Replace | Loss of Customer | Business Expert 2 | 0.40 | $2,000,000 | $30,000,000 | $150,000 |

| Replace | Loss of Customer | Business Expert 3 | 0.25 | $1,200,000 | $15,000,000 | $75,000 |

| Replace | Loss of Customer | Unicorn Expert | 0.10 | $1,000,000 | $15,000,000 | $75,000 |

Consensus Estimate

Using a simple average of all experts that provided an estimate (not blank/NA), this gives us a consensus estimate for the three risks of:

Code

consensus |>

mutate(across(p50:p05, ~ currency(.x, digits = 0L))) |>

formattable(align = "l")| treatment | risk | lambda | p50 | p95 | p05 |

|---|---|---|---|---|---|

| None | Cybersecurity Breach | 0.2575 | $318,750 | $44,250,000 | $1,850 |

| None | Loss of Customer | 2.0000 | $1,425,000 | $20,000,000 | $100,000 |

| None | Technology Outage | 2.0000 | $13,000 | $187,500 | $669 |

| Replace | Cybersecurity Breach | 0.1000 | $318,750 | $44,250,000 | $1,850 |

| Replace | Loss of Customer | 0.2375 | $1,425,000 | $20,000,000 | $100,000 |

| Replace | Technology Outage | 1.1250 | $9,625 | $147,500 | $669 |

The consensus estimates result in the following parameters for log-normal loss magnitude. When both p05 and p95 are provided, the p50 estimate is used to calculate the percentage difference from the actual median (mdiff), a measure of estimate accuracy (otherwise mdiff is NA):

Code

consensus_params |>

mutate(across(p05:p50, ~ currency(.x, digits = 0L)), mdiff = percent(mdiff)) |>

formattable(align = "l")| treatment | risk | lambda | p50 | p95 | p05 | meanlog | sdlog | mdiff |

|---|---|---|---|---|---|---|---|---|

| None | Cybersecurity Breach | 0.2575 | $318,750 | $44,250,000 | $1,850 | 12.564153 | 3.064840 | 11.41% |

| None | Loss of Customer | 2.0000 | $1,425,000 | $20,000,000 | $100,000 | 14.162084 | 1.610574 | 0.76% |

| None | Technology Outage | 2.0000 | $13,000 | $187,500 | $669 | 9.323472 | 1.713260 | 16.09% |

| Replace | Cybersecurity Breach | 0.1000 | $318,750 | $44,250,000 | $1,850 | 12.564153 | 3.064840 | 11.41% |

| Replace | Loss of Customer | 0.2375 | $1,425,000 | $20,000,000 | $100,000 | 14.162084 | 1.610574 | 0.76% |

| Replace | Technology Outage | 1.1250 | $9,625 | $147,500 | $669 | 9.203497 | 1.640320 | -3.09% |

Forecast Summary

A summary() of the forecast results.

Code

summary(forecast) year risk treatment events

Min. : 1 Length:150000 Length:150000 Min. : 0.0000

1st Qu.: 6251 Class :character Class :character 1st Qu.: 0.0000

Median :12500 Mode :character Mode :character Median : 0.0000

Mean :12500 Mean : 0.9553

3rd Qu.:18750 3rd Qu.: 2.0000

Max. :25000 Max. :10.0000

losses

Min. :0.000e+00

1st Qu.:0.000e+00

Median :0.000e+00

Mean :3.329e+06

3rd Qu.:1.323e+05

Max. :7.983e+09